Conveniences particularly cellular phone bank dumps are sweet, but exactly how much are they costing your? Your own report might not inform you the costs yourself, but there is a classic saying regarding things along these lines: If you aren’t investing in a support, you’re not the customer. You may be the merchandise. In this instance, corporate banking companies explore smooth scientific special features to get you from inside the therefore you will be likely to sign up for fund and you can have fun with almost every other having-shell out properties. When you’re sick and tired of receiving treatment such as for instance a product or service, you aren’t by yourself. A year ago, 2 billion anyone amongst the ages of 18 and you can thirty-five joined a credit connection. Actually, 28% out of borrowing commitment people is around 35 when you find yourself 54% ones is actually under years fifty. The various tools out-of technology make they simpler to see the worth one to borrowing unions provide. Do not just bring all of our phrase for this. Do your homework and watch for yourself just how borrowing unions contrast in order to to own-money banking companies.

step 1. Simple solution

Here’s a fun game. Name a business bank having an easy consult, such as for instance checking the balance away from a checking account. Amount the number of annoying mobile tree menus you have got to sift through before you can correspond with a bona fide person who you may answr fully your question. You winnings if you get annoyed and you can slam the phone off in the rage! For-profit banking institutions have earned a track record for difficult support service and out-of-touch policies. Borrowing unions, on top of that, offer easy-to-fool around with qualities and you will actual, live human beings who can answer questions, generate advice that assist you understand the latest complicated arena of money.

dos. Lending means

For-finances banking companies answer to business owners. They expect a foreseeable, stable rates of get back on the investments. It consult throws an effective straitjacket towards lending and you will assures the individuals strategies never deviate regarding a predetermined algorithm. There isn’t any area to own autonomy and you may interest levels is a lot higher. Borrowing unions are neighborhood associations, so providing anybody away is part of their work. Their prices become below that from business banks. Nevertheless they are more happy to create conditions having details that may not be mirrored on the conventional credit formula.

step three. On the internet financial are everywhere

In the great outdoors West days of the web based, just corporate banks you will definitely afford on line financial. Today, your pet gerbil have his personal site. The web are every where and borrowing from the bank unions take panel. The services make use of each day, for example on the web bill shell out, head put and you can looking into account stability are just a just click here aside.

4. Educational resources

Business banking institutions have over the years produced a killing by keeping people in brand new black about their means. Credit card companies managed to get tough to share with how much cash appeal you were are energized. Banking institutions billed overdraft charge in place of actually ever letting you know these were undertaking it. These materials had so very bad, Congress grabbed action. User lack of knowledge try integrated into the brand new https://paydayloanalabama.com/westover/ money brand of big economic organizations. Educating people was not only a waste of currency on them, it had been actually costing all of them team. Credit unions commonly-for-earnings that need and come up with their communities a much better put. Element of you to definitely goal includes economic knowledge. If you need advice for real estate, while making a spending budget or playing with credit responsibly, your own credit relationship might be happy to assist.

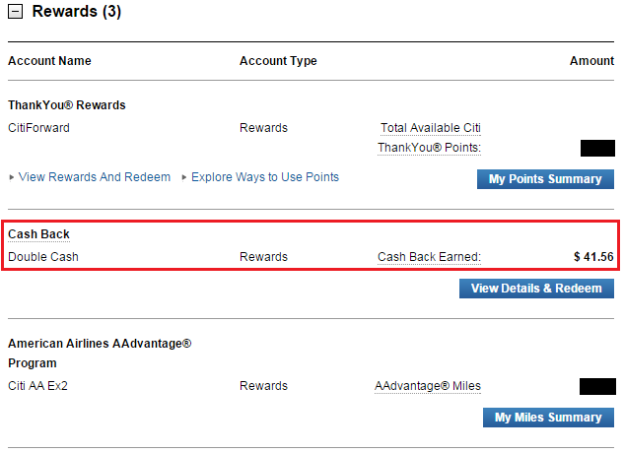

5. Deals

Borrowing from the bank unions work for their professionals. They pay back the bucks they make to their professionals inside the form of returns. As their users also are the people buying their services, they don’t have most of a reward to help you fees an arm and you can a leg inside the desire and fees. Borrowing from the bank unions also offer aggressive cost on the discounts profile and share licenses. Because they do not need certainly to siphon regarding currency to blow shareholders, they are able to go back that money to their traders: you know, the folks who do the financial towards the borrowing from the bank unionpare the fresh new earned attention with the a cards connection examining otherwise checking account to men and women offered by a concerning-profit bank. Upcoming, wade open a free account in the a card commitment. It is possible to give thanks to yourself later.